地缘博弈的终局:苏联解体与日本“失去的三十年”之谜 / The Endgame of Geopolitics: The Collapse of the Soviet Union and Japan's "Lost Three Decades"

1991年12月,苏维埃社会主义共和国联盟宣告解体,冷战格局轰然崩塌。同年,日本经济在资产泡沫破裂中陷入深渊,开启了长达三十年的停滞。这两大事件的时间耦合并非偶然——日本的经济奇迹与停滞,本质上是一部被美苏争霸裹挟的地缘政治史诗。

一、冷战前线:日本的经济奇迹源于“战略棋子”红利

1. 美国扶持的黄金时代(1950s-1980s)战后日本作为东亚对抗苏联的“桥头堡”,获得了美国的全方位扶持:

- 资本与技术输入:美国通过“道奇计划”重建日本工业体系,转移汽车、半导体等技术,使日本制造业迅速崛起。

- 市场准入特权:美国对日本商品开放市场,容忍贸易逆差,助推日本出口导向型经济腾飞。1980年代,日本汽车占据美国30%份额,半导体产业垄断全球50%以上市场。

- 军事保护伞:美国承担日本防务开支,使其得以将GDP的1%投入经济发展(同期欧美国家军费占比3%-5%)。

2. 泡沫经济的虚假繁荣在美苏对抗的高压下,日本成为西方资本避险地:

- 东京地价能买下整个美国,三菱收购纽约洛克菲勒中心,索尼吞并哥伦比亚电影公司,日元升值催生全球资产收购狂潮。

- 1989年日本人均GDP超美国,国民在银座挥舞万元大钞抢出租车,企业豪掷千亿日元购买毕加索名画。此时的繁荣,实为冷战格局下的资本泡沫。

二、1991:双重转折点的致命巧合

1. 苏联解体与日本战略价值的崩塌随着冷战结束,日本的地缘政治价值断崖式下跌:

- 美国不再需要“东亚堡垒”,撤出资本并施压日元贬值,日本失去贸易特权。

- 西方资本迅速撤离,1990-1992年外资对日投资缩减60%,日经指数暴跌60%。

2. 泡沫破裂的“完美风暴”外部抽资叠加内部政策失误,引发经济雪崩:

- 日本央行错误加息(利率从2.5%骤升至6%),刺破房地产和股市泡沫。

- 东京住宅地价暴跌61%,企业资产负债表崩溃,居民消费信心瓦解。

三、后冷战时代:被遗忘的“弃子”与结构性困局

1. 资本撤离与产业空心化

- 西方资本转向新兴市场(如中国),日本电子、汽车产业遭遇中韩夹击,夏普、东芝等巨头衰落。

- 企业为求生将生产线外迁,国内制造业岗位十年减少25%,形成“产业空洞”。

2. 政策失效与人口陷阱

- 日本尝试零利率、QE等刺激手段,但企业仍囤积现金不投资,家庭储蓄率升至15%,陷入“资产负债表衰退”。

- 老龄化加剧(65岁以上人口占比29%)与少子化导致劳动力短缺,社会保障支出挤压经济增长空间。

四、地缘政治经济学启示:大国博弈中的生存法则

日本“失去的三十年”本质是地缘政治红利消失与内生缺陷的共振:

- 冷战红利终结:失去美国庇护后,日本暴露了技术依附性强、创新动力不足的弱点。

- 战略自主缺失:作为非完全主权国家,日本无法独立调整贸易和货币政策应对变局。

- 历史周期警示:当今的台海、芯片战争印证:小国在大国博弈中易成棋子,亦易成弃子。

结语:东京的余晖与北京的警钟

1993年,当日本公务员年薪高达900万日元时,东京街头却出现“借米家庭”;当索尼游戏机畅销全球时,日本年轻人因失业沦为“平成废宅”。这段历史揭示了一个残酷逻辑:依附性繁荣终不可持续,唯有科技自主与战略独立方能穿越周期。如今中国面临类似围堵,日本的教训恰似一记警钟——地缘博弈中没有永远的赢家,只有永恒的生存之战。

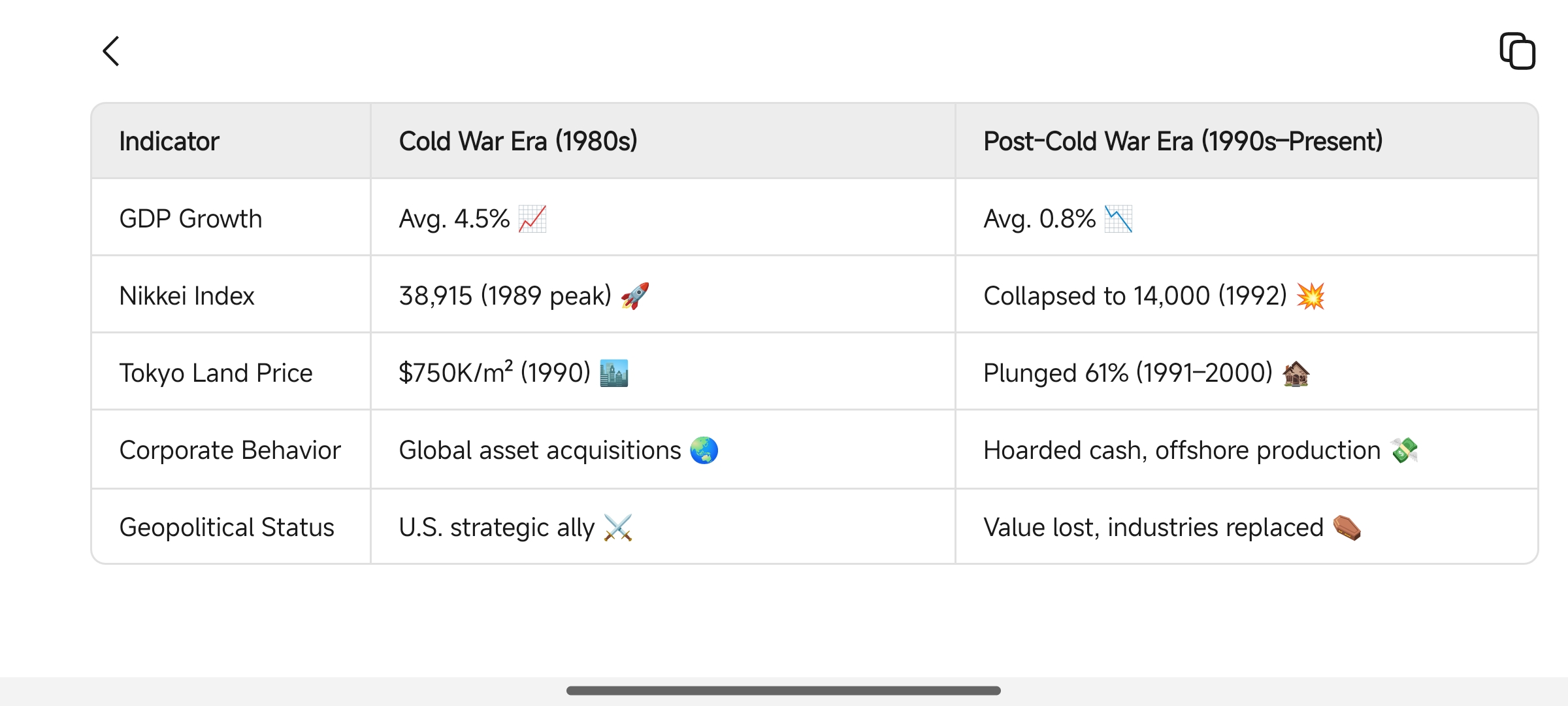

关键数据对比:冷战红利与后冷战困局

指标 冷战时期(1980s) 后冷战时期(1990s后)

GDP增速 年均4.5% 年均0.8%

日经指数 38915点(1989年峰值) 跌至14000点(1992年)

东京地价 75万美元/平方米(1990) 暴跌61%(1991-2000)

企业行为 全球收购资产 囤积现金,海外转移生产线

国际地位 美国战略盟友 失去地缘价值,产业被替代

注:本文核心逻辑基于地缘政治视角,同时纳入日本内生问题(政策失误、老龄化等)的复合作用,数据及事件均引自权威信源。苏联解体的深层影响可进一步延伸至德国统一、东欧转型研究,详见。

——————————

On December 1991, the Union of Soviet Socialist Republics dissolved, marking the abrupt end of the Cold War. That same year, Japan's economy plunged into an abyss following the burst of its asset bubble, initiating three decades of stagnation. This temporal alignment is no coincidence—Japan's economic miracle and subsequent decline fundamentally constitute a geopolitical epic shaped by the U.S.-Soviet rivalry.

I. Cold War Frontline: Japan's Economic Miracle as a "Strategic Pawn"

1. The Golden Era of U.S. Patronage (1950s-1980s)Post-war Japan served as an "East Asian bridgehead" against the Soviet Union, receiving comprehensive U.S. support:

- Capital and Technology Transfers: The "Dodge Plan" rebuilt Japan's industrial system, facilitating technology transfers in automotive and semiconductor sectors, catalyzing rapid manufacturing growth.

- Market Access Privileges: The U.S. tolerated trade deficits, granting Japan preferential access to its markets. By the 1980s, Japanese cars captured 30% of the U.S. market, while semiconductors dominated over 50% globally.

- Military Umbrella: With the U.S. covering defense costs, Japan allocated only 1% of GDP to military spending (versus 3%-5% in Western nations), freeing resources for economic development.

2. The Illusion of Bubble ProsperityAmid U.S.-Soviet tensions, Japan became a haven for Western capital:

- Tokyo's land value theoretically surpassed that of the entire U.S.; Mitsubishi acquired New York's Rockefeller Center, while Sony purchased Columbia Pictures. Yen appreciation fueled a global asset-buying spree.

- In 1989, Japan's per capita GDP exceeded America's. Extravagance peaked as locals waved 10,000-yen notes for taxis in Ginza, and corporations splurged billions on Picasso masterpieces—a prosperity built on Cold War-era capital bubbles.

II. 1991: The Fatal Confluence of Dual Turning Points

1. Soviet Collapse and the Erosion of Japan's Strategic ValueWith the Cold War's end, Japan's geopolitical significance collapsed:

- The U.S. withdrew capital and pressured yen devaluation, stripping Japan of trade privileges. Western capital fled rapidly, with foreign investment plunging 60% during 1990–1992, triggering a 60% Nikkei crash.

2. The "Perfect Storm" of Bubble BurstExternal capital flight compounded domestic policy errors:

- The Bank of Japan (BOJ) raised interest rates from 2.5% to 6%, puncturing real estate and stock bubbles.

- Tokyo residential land prices crashed 61%, corporate balance sheets imploded, and consumer confidence evaporated.

III. Post-Cold War Era: The Forgotten "Pawn" and Structural Traps

1. Capital Flight and Industrial Hollowing

- Western capital shifted to emerging markets (e.g., China). Japanese electronics and automotive industries faced competition from South Korea and China, leading to the decline of giants like Sharp and Toshiba.

- Manufacturers relocated overseas, cutting domestic industrial jobs by 25% and creating an "industrial void".

2. Policy Failures and Demographic Traps

- Zero-interest rates and quantitative easing (QE) failed to stimulate investment. Corporations hoarded cash while households increased savings to 15%, resulting in "balance sheet recession".

- Aging demographics (29% over 65) and low birthrates strained labor supply, with social security costs suffocating growth.

IV. Geopolitical Economics: Lessons for Survival in Great-Power Rivalry

Japan's "Lost Three Decades" reveal a resonance between vanished geopolitical dividends and inherent flaws:

- End of Cold War Dividends: Without U.S. patronage, Japan's weaknesses—technological dependency and weak innovation—were exposed.

- Lack of Strategic Autonomy: As a semi-sovereign state, Japan could not independently adjust trade or monetary policies.

- Historical Cyclicality: Current Taiwan Strait tensions and semiconductor wars confirm: smaller nations risk becoming pawns—or sacrifices—in great-power games.

Epilogue: Tokyo's Twilight and Beijing's Warning Bell

In 1993, as Japanese bureaucrats earned ¥9 million annually, families queued for rice donations in Tokyo streets; while Sony Playstations sold globally, jobless youth became the "Heisei NEETs." This history unveils a brutal logic: Dependent prosperity is ultimately unsustainable—only technological autonomy and strategic independence can transcend cycles. Today, as China faces similar containment, Japan's lesson echoes: There are no permanent winners in geopolitical games, only eternal battles for survival.

Key Data: Cold War Dividends vs. Post-Cold War Dilemmas

Indicator Cold War Era (1980s) Post-Cold War Era (1990s–Present)

GDP Growth Avg. 4.5% Avg. 0.8%

Nikkei Index 38,915 (1989 peak) Collapsed to 14,000 (1992)

Tokyo Land Price $750K/m² (1990) Plunged 61% (1991–2000)

Corporate Behavior Global asset acquisitions Hoarded cash, offshore production

Geopolitical Status U.S. strategic ally Value lost, industries replaced

Note: Core arguments integrate geopolitical perspectives with endogenous factors (policy errors, demographics). Data and events cite authoritative sources. For extended analysis of the Soviet collapse's impact (e.g., German reunification, Eastern Europe transitions), see .

一、冷战前线:日本的经济奇迹源于“战略棋子”红利

1. 美国扶持的黄金时代(1950s-1980s)战后日本作为东亚对抗苏联的“桥头堡”,获得了美国的全方位扶持:

- 资本与技术输入:美国通过“道奇计划”重建日本工业体系,转移汽车、半导体等技术,使日本制造业迅速崛起。

- 市场准入特权:美国对日本商品开放市场,容忍贸易逆差,助推日本出口导向型经济腾飞。1980年代,日本汽车占据美国30%份额,半导体产业垄断全球50%以上市场。

- 军事保护伞:美国承担日本防务开支,使其得以将GDP的1%投入经济发展(同期欧美国家军费占比3%-5%)。

2. 泡沫经济的虚假繁荣在美苏对抗的高压下,日本成为西方资本避险地:

- 东京地价能买下整个美国,三菱收购纽约洛克菲勒中心,索尼吞并哥伦比亚电影公司,日元升值催生全球资产收购狂潮。

- 1989年日本人均GDP超美国,国民在银座挥舞万元大钞抢出租车,企业豪掷千亿日元购买毕加索名画。此时的繁荣,实为冷战格局下的资本泡沫。

二、1991:双重转折点的致命巧合

1. 苏联解体与日本战略价值的崩塌随着冷战结束,日本的地缘政治价值断崖式下跌:

- 美国不再需要“东亚堡垒”,撤出资本并施压日元贬值,日本失去贸易特权。

- 西方资本迅速撤离,1990-1992年外资对日投资缩减60%,日经指数暴跌60%。

2. 泡沫破裂的“完美风暴”外部抽资叠加内部政策失误,引发经济雪崩:

- 日本央行错误加息(利率从2.5%骤升至6%),刺破房地产和股市泡沫。

- 东京住宅地价暴跌61%,企业资产负债表崩溃,居民消费信心瓦解。

三、后冷战时代:被遗忘的“弃子”与结构性困局

1. 资本撤离与产业空心化

- 西方资本转向新兴市场(如中国),日本电子、汽车产业遭遇中韩夹击,夏普、东芝等巨头衰落。

- 企业为求生将生产线外迁,国内制造业岗位十年减少25%,形成“产业空洞”。

2. 政策失效与人口陷阱

- 日本尝试零利率、QE等刺激手段,但企业仍囤积现金不投资,家庭储蓄率升至15%,陷入“资产负债表衰退”。

- 老龄化加剧(65岁以上人口占比29%)与少子化导致劳动力短缺,社会保障支出挤压经济增长空间。

四、地缘政治经济学启示:大国博弈中的生存法则

日本“失去的三十年”本质是地缘政治红利消失与内生缺陷的共振:

- 冷战红利终结:失去美国庇护后,日本暴露了技术依附性强、创新动力不足的弱点。

- 战略自主缺失:作为非完全主权国家,日本无法独立调整贸易和货币政策应对变局。

- 历史周期警示:当今的台海、芯片战争印证:小国在大国博弈中易成棋子,亦易成弃子。

结语:东京的余晖与北京的警钟

1993年,当日本公务员年薪高达900万日元时,东京街头却出现“借米家庭”;当索尼游戏机畅销全球时,日本年轻人因失业沦为“平成废宅”。这段历史揭示了一个残酷逻辑:依附性繁荣终不可持续,唯有科技自主与战略独立方能穿越周期。如今中国面临类似围堵,日本的教训恰似一记警钟——地缘博弈中没有永远的赢家,只有永恒的生存之战。

关键数据对比:冷战红利与后冷战困局

指标 冷战时期(1980s) 后冷战时期(1990s后)

GDP增速 年均4.5% 年均0.8%

日经指数 38915点(1989年峰值) 跌至14000点(1992年)

东京地价 75万美元/平方米(1990) 暴跌61%(1991-2000)

企业行为 全球收购资产 囤积现金,海外转移生产线

国际地位 美国战略盟友 失去地缘价值,产业被替代

注:本文核心逻辑基于地缘政治视角,同时纳入日本内生问题(政策失误、老龄化等)的复合作用,数据及事件均引自权威信源。苏联解体的深层影响可进一步延伸至德国统一、东欧转型研究,详见。

——————————

On December 1991, the Union of Soviet Socialist Republics dissolved, marking the abrupt end of the Cold War. That same year, Japan's economy plunged into an abyss following the burst of its asset bubble, initiating three decades of stagnation. This temporal alignment is no coincidence—Japan's economic miracle and subsequent decline fundamentally constitute a geopolitical epic shaped by the U.S.-Soviet rivalry.

I. Cold War Frontline: Japan's Economic Miracle as a "Strategic Pawn"

1. The Golden Era of U.S. Patronage (1950s-1980s)Post-war Japan served as an "East Asian bridgehead" against the Soviet Union, receiving comprehensive U.S. support:

- Capital and Technology Transfers: The "Dodge Plan" rebuilt Japan's industrial system, facilitating technology transfers in automotive and semiconductor sectors, catalyzing rapid manufacturing growth.

- Market Access Privileges: The U.S. tolerated trade deficits, granting Japan preferential access to its markets. By the 1980s, Japanese cars captured 30% of the U.S. market, while semiconductors dominated over 50% globally.

- Military Umbrella: With the U.S. covering defense costs, Japan allocated only 1% of GDP to military spending (versus 3%-5% in Western nations), freeing resources for economic development.

2. The Illusion of Bubble ProsperityAmid U.S.-Soviet tensions, Japan became a haven for Western capital:

- Tokyo's land value theoretically surpassed that of the entire U.S.; Mitsubishi acquired New York's Rockefeller Center, while Sony purchased Columbia Pictures. Yen appreciation fueled a global asset-buying spree.

- In 1989, Japan's per capita GDP exceeded America's. Extravagance peaked as locals waved 10,000-yen notes for taxis in Ginza, and corporations splurged billions on Picasso masterpieces—a prosperity built on Cold War-era capital bubbles.

II. 1991: The Fatal Confluence of Dual Turning Points

1. Soviet Collapse and the Erosion of Japan's Strategic ValueWith the Cold War's end, Japan's geopolitical significance collapsed:

- The U.S. withdrew capital and pressured yen devaluation, stripping Japan of trade privileges. Western capital fled rapidly, with foreign investment plunging 60% during 1990–1992, triggering a 60% Nikkei crash.

2. The "Perfect Storm" of Bubble BurstExternal capital flight compounded domestic policy errors:

- The Bank of Japan (BOJ) raised interest rates from 2.5% to 6%, puncturing real estate and stock bubbles.

- Tokyo residential land prices crashed 61%, corporate balance sheets imploded, and consumer confidence evaporated.

III. Post-Cold War Era: The Forgotten "Pawn" and Structural Traps

1. Capital Flight and Industrial Hollowing

- Western capital shifted to emerging markets (e.g., China). Japanese electronics and automotive industries faced competition from South Korea and China, leading to the decline of giants like Sharp and Toshiba.

- Manufacturers relocated overseas, cutting domestic industrial jobs by 25% and creating an "industrial void".

2. Policy Failures and Demographic Traps

- Zero-interest rates and quantitative easing (QE) failed to stimulate investment. Corporations hoarded cash while households increased savings to 15%, resulting in "balance sheet recession".

- Aging demographics (29% over 65) and low birthrates strained labor supply, with social security costs suffocating growth.

IV. Geopolitical Economics: Lessons for Survival in Great-Power Rivalry

Japan's "Lost Three Decades" reveal a resonance between vanished geopolitical dividends and inherent flaws:

- End of Cold War Dividends: Without U.S. patronage, Japan's weaknesses—technological dependency and weak innovation—were exposed.

- Lack of Strategic Autonomy: As a semi-sovereign state, Japan could not independently adjust trade or monetary policies.

- Historical Cyclicality: Current Taiwan Strait tensions and semiconductor wars confirm: smaller nations risk becoming pawns—or sacrifices—in great-power games.

Epilogue: Tokyo's Twilight and Beijing's Warning Bell

In 1993, as Japanese bureaucrats earned ¥9 million annually, families queued for rice donations in Tokyo streets; while Sony Playstations sold globally, jobless youth became the "Heisei NEETs." This history unveils a brutal logic: Dependent prosperity is ultimately unsustainable—only technological autonomy and strategic independence can transcend cycles. Today, as China faces similar containment, Japan's lesson echoes: There are no permanent winners in geopolitical games, only eternal battles for survival.

Key Data: Cold War Dividends vs. Post-Cold War Dilemmas

Indicator Cold War Era (1980s) Post-Cold War Era (1990s–Present)

GDP Growth Avg. 4.5% Avg. 0.8%

Nikkei Index 38,915 (1989 peak) Collapsed to 14,000 (1992)

Tokyo Land Price $750K/m² (1990) Plunged 61% (1991–2000)

Corporate Behavior Global asset acquisitions Hoarded cash, offshore production

Geopolitical Status U.S. strategic ally Value lost, industries replaced

Note: Core arguments integrate geopolitical perspectives with endogenous factors (policy errors, demographics). Data and events cite authoritative sources. For extended analysis of the Soviet collapse's impact (e.g., German reunification, Eastern Europe transitions), see .

附件文件 File